Working with Electronic Invoices

Sales Documents

Sales Orders and Invoices

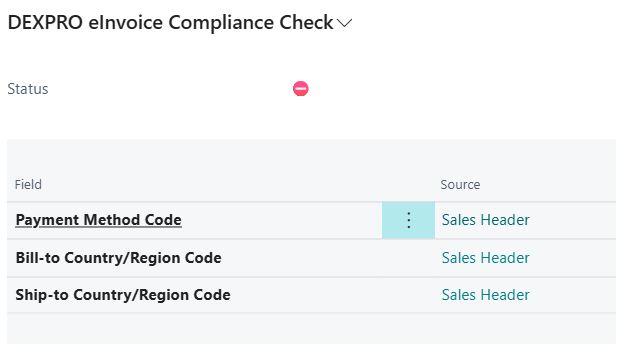

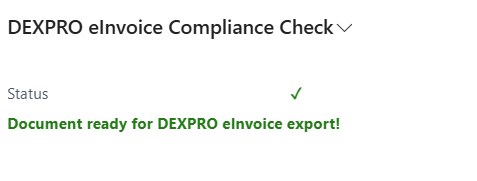

Sales documents such as orders and invoices now have a fact box for the e-invoice conformity check. This informs the user of the following:

- Required fields that are empty

- Validation warnings

- Compliance status

Common Missing Fields:

- Customer VAT registration numbers

- Complete billing addresses

- Valid email addresses

- Payment method codes

Posted Sales Invoices

In the Posted Sales Invoices list, you'll see:

New Fields:

- DXP eInvoice Document Sent: Shows if electronic document was sent

New Actions:

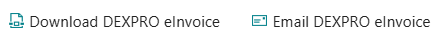

- Download DEXPRO eInvoice: Download electronic document

- Email DEXPRO eInvoice: Send electronic document via email

Posted Sales Credit Memos

Similar functionality available in Posted Sales Credit Memos:

- Document status tracking

- Download and email actions

Service Invoices

Electronic invoicing is also available for Service Invoices with the same functionality.

Document Types and Formats

When downloading or emailing documents, you can choose from:

- XRechnung XML: Pure XML format compliant with German standards

- ZUGFeRD PDF: Hybrid PDF with embedded XML data

- XRechnung XML and Standard PDF: Both formats in a ZIP file

Sending Documents

Manual Sending

- Open any posted sales document

- Click Email DEXPRO eInvoice

- Select the desired format

- System automatically:

- Generates the electronic document

- Creates email with appropriate template

- Sends to customer's email address

Automatic Processing

The system can automatically process documents through the Document Queue:

- Documents are queued when posted

- Background processing generates and sends electronic documents

- Status tracking shows processing progress

No Comments